Auroch searching for buried treasure at Nepean Deeps

Published 23-JUN-2021 12:15 P.M.

|

3 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Auroch Minerals Limited (ASX: AOU) has started planning the 3,000 metre drill programme at its Nepean Nickel Project (80% Auroch Minerals) near Coolgardie in Western Australia.

The high priority programme will comprise up to five drill-holes targeting economic nickel sulphide mineralisation below the historic Nepean nickel mine workings.

Auroch’s share price appears to have come under pressure due to a sharp decline in the nickel price in recent weeks.

However, it should be noted that the retracement was from a high of US$8.34 per pound, a level it hadn’t traded at for more than five years.

Nickel has had an outstanding rally, increasing from less than US$6.00 per pound 12 months ago to hit a high of about US$8.80 per pound in February.

It was a retracement in June from US$8.34 per pound to US$7.84 per pound that placed a drag on Auroch, but it is worth noting that in the last two days there has been a rebound to US$8.06 per pound.

Hence, upcoming work at the historic high-grade Nepean nickel sulphide mine bodes well for the company.

High-grade nickel @ US$8.00/lb = substantial cash flow

Nepean was the second producing nickel mine in Australia, produced more than 1.1 million tonnes of ore between 1970 and 1987 for over 32,000 tonnes of nickel metal at an average recovered grade of 2.99% Ni.

To be able to produce these grades in a high nickel price environment would generate substantial cash flow for Auroch.

Interestingly, production ceased in 1987 due to very low nickel prices, leaving in-situ a significant historic remnant nickel sulphide resource.

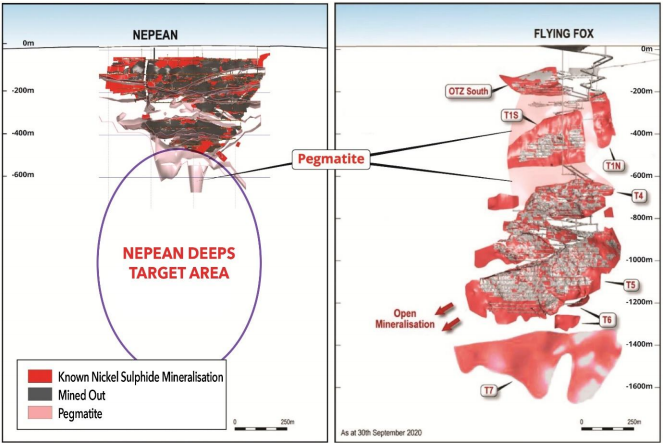

A large flat-lying pegmatite vein cross-cuts the nickel sulphide mineralisation at the base of the Nepean mine workings, drawing an analogy to Western Areas’ (ASX:WSA) Flying Fox nickel mine in Western Australia, where despite several large cross-cutting granite sills the nickel sulphide mineralisation continues at depth below the sills as shown below.

The Flying Fox mine remains in operation having mined down to 1,200 metres below the surface and produced over 100,000 tonnes of nickel more to come.

Nepean Deeps is the key to the future

Despite the analogy to the Flying Fox nickel deposit and the high-grade historic production of the Nepean mine, no significant exploration down-plunge of the mine has occurred, with effectively no drilling into the “Nepean Deeps” target area highlighted above.

In discussing the upcoming exploration campaign and the significance of Nepean Deeps, Auroch managing director Aidan Platel said, “We are extremely excited to begin work on our maiden drill programme of the Nepean Deeps target.

"The life of the historic high-grade Nepean nickel mine was cut short in 1987 when nickel dropped to below US$4,000/t (currently more than US$17,000 per tonne), so we knew when we acquired this project that it still had a lot more to give.

"The presence of the flat-lying pegmatite vein at the base of the old mine workings is an important factor in our drilling strategy as we know geologically that the pegmatite veins are later features that developed a long time after the massive nickel sulphides were emplaced in the basal channel, and hence, logically, the channel and the nickel mineralisation should continue beneath the pegmatite, exactly as was the case at Flying Fox.

"As such, the Nepean Deeps target area is a very high-priority target area and we look forward to commencing our maiden drill programme there next month.”

For more information read this Wise Owl report, then follow the links to the Company Page: AOU to Drill for Nickel Underneath Historic Nickel Mine

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.