ATC lowers costs as it seeks project funding

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

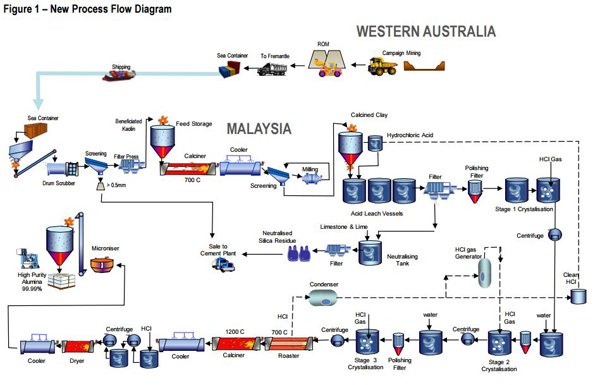

Altech Chemicals’ (ASX:ATC) kaolin beneficiation plant will now be in Malaysia instead of Australia after further studies identified it would reduce capital costs, just as it takes its plans to potential financiers.

The high-purity alumina player told shareholders today that it had been tweaking its plan around the edges since it completed a bankable feasibility study on the project at the end of June.

In that plan, ATC was to take kaolin clay from Meckering in WA, put it through a beneficiation plant on site to produce a dry kaolin product with 30% aluminium oxide.

It would then be processed further at a processing plant in Johor, Malaysia.

However, ATC has found that by putting the beneficiation plant in Malaysia it would simplify the process, despite needing to ship higher tonnages of raw kaolin clay from WA.

Before it would have had to transport 18,5000 tonnes of dry beneficiated kaolin to Malaysia per year, but under the new plan it will need to ship 40,000/tpa of raw kaolin clay.

The savings, ATC said, would come in reduced costs in Malaysia for the plant.

The new flow sheet for ATC’s high purity alumina project

It said the plant would be smaller, but be able to operate 24 hours a day instead of 12 hours, benefitting from cheaper energy costs by being located in a key industrial precinct in Malaysia.

ATC will also save cash because a dryer, bagging unit, and supporting infrastructure will not be needed at the new plant.

The raw kaolin will simply be bagged and sent to Malaysia without needing to be dried first.

Funding fight

ATC is in the middle of trying to raise funding for the project, and managing director Iggy Tan said the changes would not affect the net present value of the project, but rather reduce capex and opex.

“The impacts on project NPV will be minimal, however the simplification of the beneficiation flow sheet and the synergies of having all the major project infrastructure at one site and within one jurisdiction, Malaysia, will deliver both operating and project financing advantages,” he said.

ATC is currently trying to sort out financing for the project, and recently piqued the curiosity of a “major German bank”.

It inked a letter of intent with the bank, but the LOI will need ‘export credit insurance’ for the LOI to turn into a fully-fledged deal.

Because the loan would essentially be an export loan, Euler Hermes, the German Export Credit Agency, would need to provide the cover.

The funding would count as an export loan because German group M+W will be doing the engineering procurement and construction work on the project.

However, a lowering of opex and possibly capex would reduce the amount ATC would need to seek from financiers.

The project

The company is aiming to mine a 65Mt JORC-compliant aluminous clay in WA which will be processed at a beneficiation plant on site, producing 25,000t of alumina-rich kaolin clay per year.

It recently snagged a $3 million deal with Dana Shipping and Trading for the shipping company to access mining rights for the clay ATC doesn’t need.

The clay will then be taken to a manufacturing plant in Malaysia with production capacity of 4000t per year, using its technology to turn the clay into a 99.99% pure HPA product.

It also recently it signed up industrial giant Mitsubishi to act as a sales agent for its finished product, giving ATC an entry into the lucrative Japanese market.

ATC has previously told investors that Japan accounted for 21% of HPA demand in 2014.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.