Allons-y! Start-ups and the Netflix age

Published 14-JAN-2016 14:44 P.M.

|

4 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Start-ups are all the rage right now, and Paris is the latest city to try and catch the fever.

According to The Guardian, Paris’ mayor Anne Hidalgo has given the green light to an ambitious plan to convert an old railway yard into an incubator, at the cost of €200 million ($A313.4 million).

The project is primarily financed by private investment, but the city government is throwing in €70 million to beautify the surrounding area.

The private money flowing into the project is reportedly coming from Xavier Niel, a co-owner of the Le Monde newspaper.

According to the project’s proponents, it will aim to attract 1000 start-ups to the incubator, a mix of French and internationals.

The proposed building. Copyright Wilmotte & Associes Architecture

It’s a further sign governments around the world are trying to stimulate their own start-up economies, such as those found in Tel-Aviv and Silicon Valley.

Closer to home, the New South Wales government announced in October last year that it would attempt to convert the run-down White Bay Power Station into a tech hub to attract start-ups.

In both the Parisian and Sydney examples, the symbolism couldn’t be more delicious.

Two technologies which are thought to be bastions of the past in a coal-fired power plant and a disused railway yard are being replaced with forward-looking tech hubs.

So why are governments attempting to lure the best and brightest into the fold?

Mostly, this.

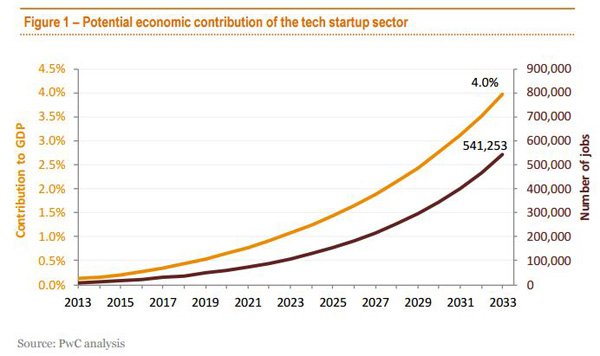

PWC analysis of the start-up sector in Australia

Given, this is from a 2013 report so the numbers may be a touch off, but the growth pattern is there for all to see.

Tech start-ups could attribute for 4% of Australian GDP by 2033 if PWC is on the money. Just as a guide, at the height of the mining investment and construction boom it is thought mining contributed a total of about 8.5% to GDP at the end of 2014.

The sector is also thought to have hired about 2% of the workforce with about 220,000 people employed. By 2033, PWC is tipping the tech start-up sector to employ about 540,000 people.

Even accounting for inflation in both economics and population, it’s pretty clear that the start-up sector is going to be a pretty hefty contributor into the future.

That’s generally why you hear Malcolm Turnbull bang on about ‘agility’ every so often.

It’s not just Australia, with a similar picture expected to unfold around the world.

It’s why governments both national and state, and some private sector interest, are competing to build the best environments to attract start-ups.

Hence the conversion of power stations and railway yards.

What’s driving this though? A spirit of entrepreneurship, sure. Increased mobility of labour also helps. However, it’s something as mundane as improved internet access which is really lighting a fire under the start-up revolution.

Netflix, which grew from a DVD mail out service to a streaming behemoth recently announced with much hoopla that it was now available in 190 countries around the world.

It was described breathlessly by Netflix CEO Reed Hastings as “the birth of a new global Internet TV network”.

When you think about it...yes, Netflix is now a global Internet TV network.

So what does this have to do with start-ups?

Well, Netflix now being available in 190 countries also means that there is internet infrastructure able to support the streaming of video content in 190 countries around the world.

While there’s still more work to do on internet connectivity in some of the poorer regions on earth, that’s a somewhat mind-blowing fact.

Streaming video is an activity which requires a lot of bandwidth, and the fact that Netflix is able to operate in 190 countries is a good sign.

It means digitally focused start-up operations can have confidence that their business may have maximum reach rather than being limited by internet speeds.

It also allows greater collaboration around the world, and opens up all sorts of e-commerce opportunities that start-ups are currently exploring – all of which are underpinned by the exchange of huge amounts of data.

With the virtual infrastructure getting there (but not quite there), governments are moving to make sure the actual physical infrastructure and policy is there too.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.