Airbus order a strong endorsement of Titomic technology

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

Shares in Australian industrial scale metal additive manufacturing company, Titomic Limited (ASX:TTT) were up as much as 30% on Thursday after management announced that it had received a Purchase Order for a Statement of Work with Airbus.

This relates to the group’s Titomic Kinetic Fusion® (TKF) additive manufacture (AM) of 3D near-net demonstrator parts for a targeted application to be performance tested in mock qualification.

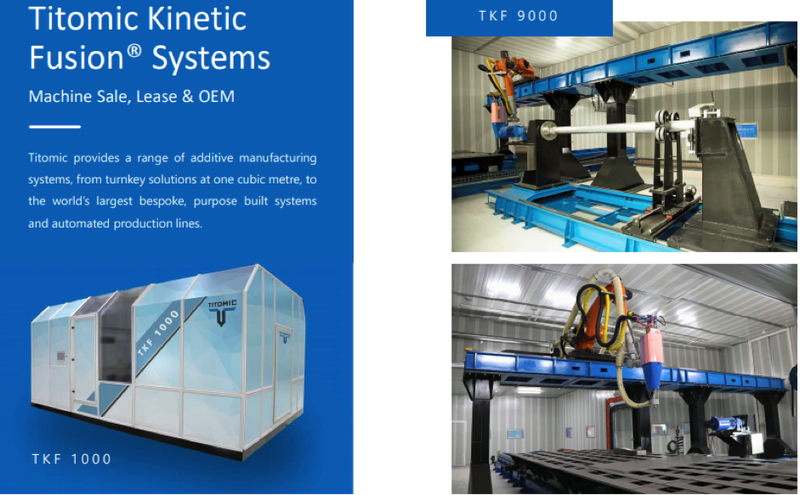

To provide some background, Titomic is positioned to change the value proposition of Titanium, unlocking new applications and opening opportunities that are now technically and economically viable with its proprietary Titomic Kinetic FusionTM (TKF) technology platform.

TKF overcomes the limitations of additive manufacturing (3D printing) for metals to manufacture complex parts without shape or size constraints.

The technology offers production run capability to organisations, which enables speed-to-market, superior products with lower production inputs using fewer resources for a more sustainable future.

TKF exponentially increases productivity

Titomic will support, advise and perform works towards the creation and provision of parts and research data for the advancement of multi-material 3D near-net demonstrator parts for Airbus using TKF additive manufacturing.

This will be achieved through an initial material and process development phase followed by a representative geometry demonstration.

Titomic’s patented TKF additive manufacturing process will be used to create demonstrator parts to determine the end to end process for multi-material additive manufacturing, such that key learnings may be derived and applied to other application specific material combinations.

Commenting on the significance of the Airbus purchase order and underlining the group’s broader position in the aerospace industry, Titomic managing director Jeff Lang said, ‘’We are pleased to partner with Airbus, to demonstrate high performance metal parts produced using the Titomic Kinetic Fusion metal additive manufacturing process with this initial $50,000 part.

‘’The TKF technology, the world’s largest and fastest industrial scale metal additive manufacturing process, is perfectly suited to produce near-net shape metal parts for the aerospace industry using our patented process of fusing dissimilar metals that cannot be produced with either traditional fabrication methods, or metal melt-based 3D Printers.

The unique capabilities of Titomic’s TKF technology surpass the constraints of other metal 3D printing methods creating an inflection point for additive manufacturing to exponentially increase productivity, delivering faster build rates compared to traditional machined aircraft parts.

Titomic and Triton Systems Inc team up with US Department of Defence

This news comes less than a fortnight after the company entered into a strategic partnership with the US-based global product development and technology company Triton Systems Inc to implement Titomic’s Kinetic Fusion (TKFTM) capabilities for validation through R&D projects with the US Department of Defence (DoD).

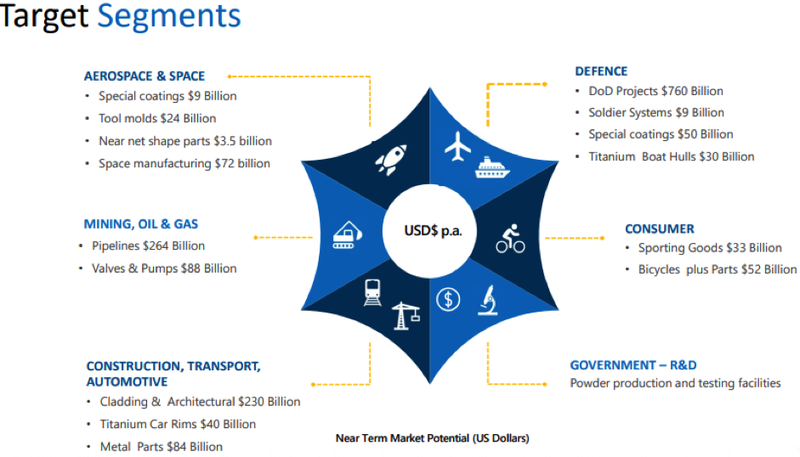

The two companies signed a strategic agreement which leverages Triton’s extensive access to the DoD and sector expertise with Titomic’s TKF technology to develop innovative products and solutions under the DoD grant scheme, including an estimated R&D budget in 2020 of US$60 billion in 2020 for adoption in project platforms.

Established in 1992, Triton Systems has become one of the most successful US research and product development companies, introducing many products used by the defence and health care sectors, and creating US$3.8 billion in shareholder value via four public offerings on the NASDAQ and the ASX, as well as executing 23 technology merger and acquisition deals.

Triton specialises in bringing specific products to a validation stage where DoD approval leads to product manufacturing.

In this case, the focus will be to enable products manufactured with Titomic’s TKF technology to meet stringent military requirements, including performance in extreme temperatures, robustness, and durability under very demanding operating environments.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.