Agriculture to thrive as global population soars

Published 07-OCT-2016 16:33 P.M.

|

2 minute read

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

As the global population continues to soar, demands placed on basic necessities will continue to rise, particularly food.

We all need to eat food right?

The United Nations forecasts that the global population will reach 9.7 billion people by 2050, from the current 7.3 billion.

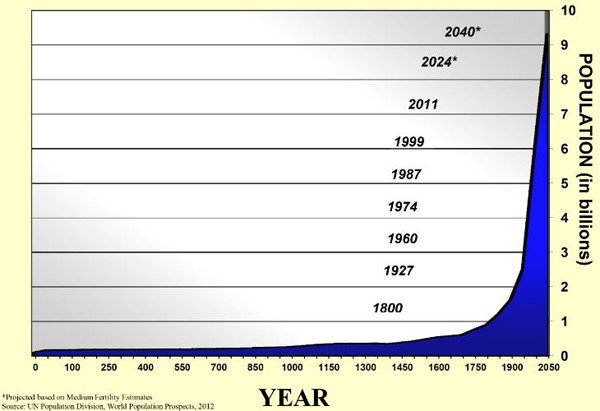

Think about it for a second, that’s more than 2.4 billion people being added within a generation. We have never experienced such exponential growth before in recorded human history:

Coupled with rising incomes causing changes in dietary consumption, the global grain output will need to increase by 50% and meat output by 200% to meet the estimated global demand by 2050.

With populated countries such as China and India experiencing a surge of citizens joining the middle class, these figures may be conservative in terms of future food requirements.

All this is set to occur whilst at the same time soil quality around the world is on the decline.

Simply supply and demand logic tells us that if this trend continues we will likely see prices for various agricultural commodities increase in the coming years and therein lies an opportunity.

What can you do about it?

For investors looking at this sector, it may be worth gaining exposure to the agricultural industry such as potash, phosphate and fertilizer and the players in it such as ASX listed Brazilian player Aguia Resources (ASX:AGR).

AGR is an early stage play so investors should approach with caution and seek professional financial advice if considering the stock for their portfolio.

Speaking geographically, Brazil has the world’s largest available unused arable land, more than the next two countries, United States and Russia combined. Further to that, Brazil has the most renewable water in the world, another commodity vital in food production.

So another option for people looking to enter the sector may be to buy agricultural land and become a grower of food yourself.

That’s a pretty difficult thing to do, but if looking at smaller scales you could start your own garden in a bid to reduce your grocery bill, as current trends suggest that food prices will continue to soar in line with global population growth and the emerging middle class.

Finally, it may just be a good time to revisit some old episodes of Burke’s Backyard, fans would know that in itself is a mighty fine investment.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.