88 Energy joint venture requires further acreage in Alaska

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

88 Energy (ASX:88E) announced on Wednesday that the company along with its joint venture partner had been awarded additional leases in a successful bidding round for acreage on the North Slope of Alaska.

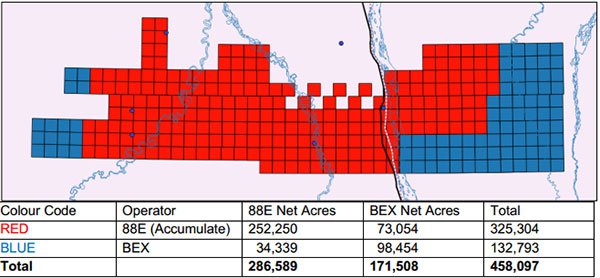

The joint venture was recently awarded certain leases successfully bid on in the 2016 North Slope licensing round. After negotiation and consideration, it was determined to take up 43 per cent of these acres with 88 Energy (via its subsidiary Accumulate Energy Alaska Inc) having a 25 per cent working interest and the remainder with Joint Venture Partner, Burgundy Xploration LLC (“BEX”), who will have the right to operate.

The following illustrates the joint venture’s updated lease position.

88E has a 77.5 per cent working interest and operatorship in circa 325,000 acres onshore the prolific North Slope of Alaska (Project Icewine). Gross contiguous acreage position for the Joint Venture is 458,097 acres (88E: 286,589 net acres).

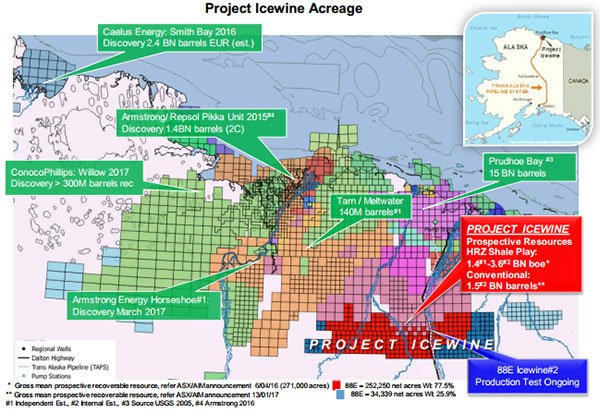

The North Slope is host to the 15 billion barrel Prudhoe Bay oilfield complex, the largest conventional oil pool in North America. 88E, along with its joint venture partner, has identified highly prospective play types that are likely to exist on the Project Icewine acreage, two being conventional and one unconventional.

This remains, however, a speculative stock and investors should seek professional financial advice if considering this stock for their portfolio.

Examining the impact on 88E in isolation, the company has increased its net acreage position from 260,000 acres to 286,000 acres. The primary target remains an untested, unconventional liquids-rich shale play in a prolific source rock, the HRZ shale (Brookian Sequence).

This co-sourced the largest oil field in North America in the giant Prudhoe Bay Oil Field Complex, and internal modelling and analysis indicates that Project Icewine is located in a high liquids vapour phase sweet spot analogous to those encountered in other Tier 1 shale plays such as the Eagle Ford, Texas.

Recently acquired 2D seismic has identified large conventional leads at Project Icewine within the same Brookian petroleum system and shallow to the HRZ shale, including potential high porosity channel and turbiditic sands associated with slope apron and deepwater fan plays.

The Brookian conventional play is proven on the North Slope. The USGS (2013) estimated the remaining oil potential to be 2.1 billion barrels within the Brookian sequence. Two recent discoveries in the Brookian have already exceeded these estimates, with Armstrong/Repsol discovering 1.4 billion barrels in 2015 and Caelus announcing a 2.5 billion barrel discovery in 2016.

Additional conventional potential exists in the Brookian delta topset play, deeper Kuparuk sands and the Ivishak Formation.

88E’s Managing Director, Dave Wall, reflected on this background when explaining the company’s 2018 strategy in saying, “The Joint Venture remains committed and confident in

the HRZ shale play, and the leasing strategy has been designed to strike a balance between this confidence and available capital whilst we build towards completion of the flowback and production testing of the Icewine#2 well in 1H 2018.”

Wall said additional details on the upcoming program as well as the planned 3D seismic acquisition will be released in the coming weeks.

General Information Only

This material has been prepared by Jason Price. Jason Price is an authorised representative (AR 000296877) of 62 Consulting Pty Limited (ABN 88 664 809 303) (AFSL 548573) (62C), and a Director of S3 Consortium Pty Ltd (trading as StocksDigital).

This material is general advice only and is not an offer for the purchase or sale of any financial product or service. The material is not intended to provide you with personal financial or tax advice and does not take into account your personal objectives, financial situation or needs. Although we believe that the material is correct, no warranty of accuracy, reliability or completeness is given, except for liability under statute which cannot be excluded. Please note that past performance may not be indicative of future performance and that no guarantee of performance, the return of capital or a particular rate of return is given by 62C, Jason Price, StocksDigital, any of their related body corporates or any other person. To the maximum extent possible, 62C, Jason Price, StocksDigital, their related body corporates or any other person do not accept any liability for any statement in this material.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.