$5.2M microcap BPM is now drilling it’s Claw gold project - 500m from $1.6BN capped gold miner

Disclosure: S3 Consortium Pty Ltd (The Company) and Associated Entities own 1,670,000 BPM shares and 850,000 BPM options at the time of publishing this article. The Company has been engaged by BPM to share our commentary on the progress of our Investment in BPM over time.

BPM Minerals (ASX:BPM) is a tiny $5.3M capped explorer that has just started exploration drilling 500m away from a 3.24 million ounce gold resource.

The gold project immediately next door to BPM is owned by the $1.6BN Capricorn Metals.

Why is BPM’s drilling suddenly interesting?

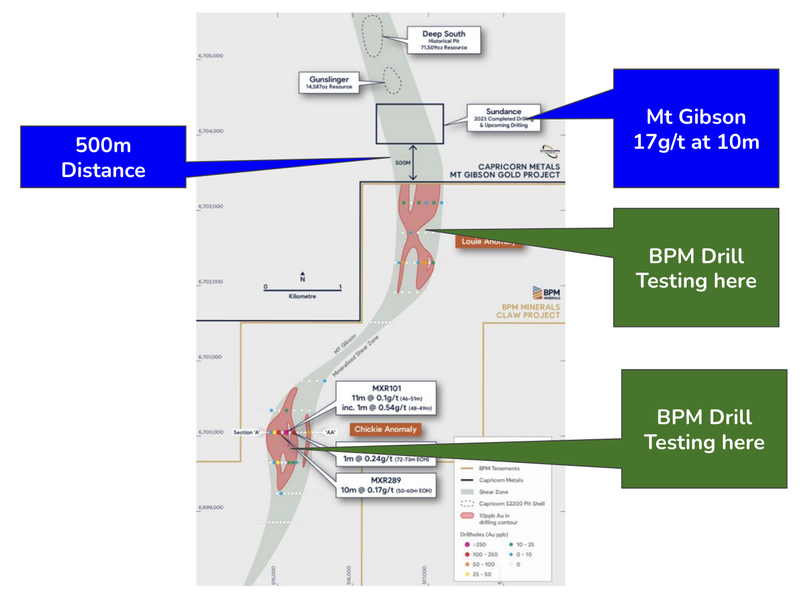

7 days ago, BPM’s big neighbour Capricorn announced a number of drill results including a 10m hit @17.16g/t from 32m.

This impressive drill hit is about 500m away and along strike to BPM’s current gold drilling...

As in happening right now.

BPM had $3.2M cash in the bank at December 31st - which gives the company a tiny $2.1M enterprise value.

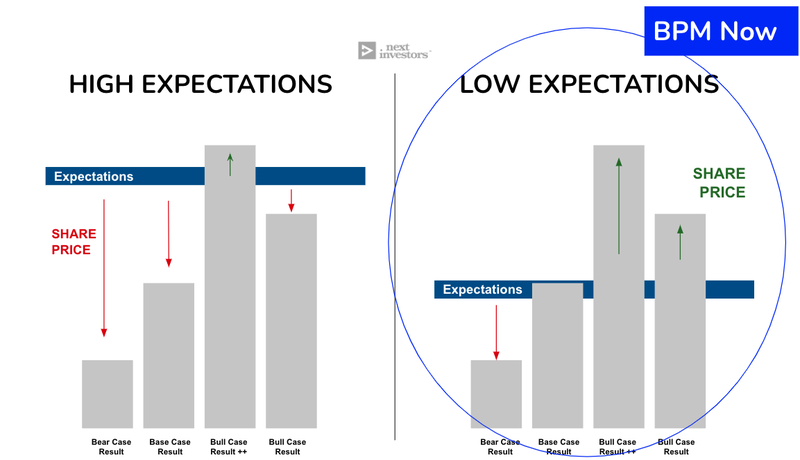

The market is ascribing almost zero value to this asset and the near term potential for a gold discovery by BPM.

With such a small EV, we think that the market expectations are LOW for this drilling campaign.

If BPM is able to make a discovery, we think it could be viewed favourably by the market.

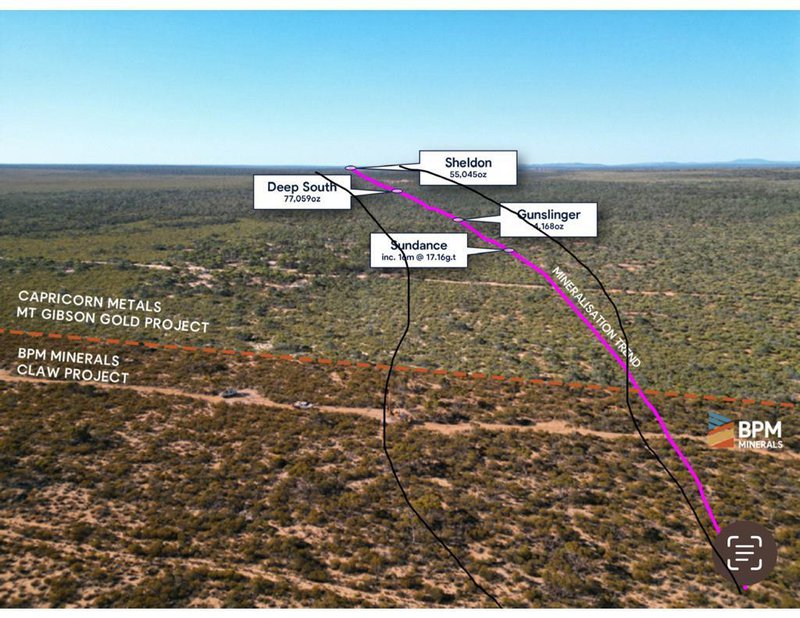

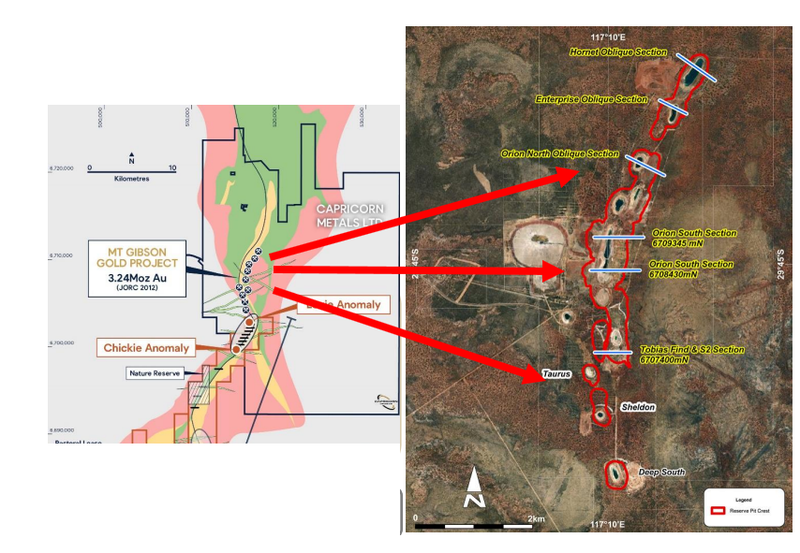

BPM is currently drilling two gold targets right near the southern border shared with Capricorn Metals.

- The Louie Prospect - 500m away from Capricorn’s mine.

- The Chickie anomaly - which covers an area of ~1,000m x 500m.

Below is an image showing just how close Capricon’s gold is to where BPM is drilling - a short stroll through low density scrubland:

The results from BPM's drilling campaign are expected next month - so we won't have long to wait here.

While most exploration companies will fail to find anything of value, the rewards can be high for investors willing to accept the risks of investing in early stage companies conducting high risk mineral exploration.

This is the game we play, and it is why we make bets on early stage exploration companies.

In parallel to the current gold drilling, in BPM’s quarterly they make mention of “continued due diligence on a number of potential new projects”... which means the $5.3M capped BPM could be looking to acquire something new in the near term...

BPM Minerals

ASX:BPM

The story behind the Claw project is an interesting one.

This is because BPM owned the ground BEFORE $1.6BN capped Capricorn Metals came in to develop the Mt Gibson Gold Project.

So, what happened?

BPM listed on the ASX in January 2021 with a suite of exploration assets - nickel, lead-zinc, gold (we first Invested for a shot at a lead-zinc discovery).

One of these exploration assets was the Claw Project, which at the time, sat next to the old Mt Gibson Gold Mine.

This mine had historically produced about ~870,000 ounces of gold during the 1980s and 90s but was put on care and maintenance when the gold price fell to ~A$450g/t.

The current price of gold is now over A$3,100g/t.

In June 2021 Capricorn Metals bought the Mt Gibson Gold Project for $39.6M - a stroke of luck for BPM as it highlighted the prospectivity of its ground next door.

Capricorn's goal with the project was to grow the JORC resource (of which was 2.1M ounces of gold at the time acquisition) and bring the project back online.

By November 2023, Capricorn had upgraded the JORC resource of the project to 3.24M ounces of gold.

Adding over a million ounces of defined gold in under 2 years is pretty impressive, and we think it improves the chances more gold might be found in the area - perhaps on BPM’s ground...

Right now, Capricorn is doing more drilling and has already started doing some of the pre-development work on site for a potential mine.

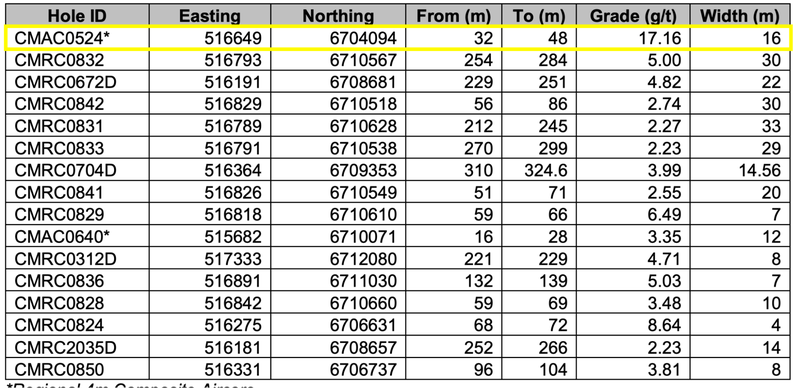

Just last week for example, Capricorn announced another set of drill results including a highlight intercept of 16m @17.16g/t from 32m.

(Source)

Why do the latest drill results relate to BPM?

These drill results are good news for BPM as its giant neighbour is investing millions of dollars proving up the gold resource next door to it.

All the drilling can inform BPM of where to pinpoint its exploration.

And last week's big hits by Capricorn were just 500m away from where BPM is drilling right now.

Our view is that any material gold discovery made by BPM would likely capture the attention of Capricorn Metals.

Having a large $1.6BN capped gold miner next door with a 3.2M ounce resource in the “pre-development stage” gives BPM a nice strategy to realise value from any gold found at its project.

With a tiny $2.1M enterprise value, we think that any discovery (big or small) could be enough to re-rate BPM’s share price higher.

This leads us to our “Big Bet” for BPM...

Our BPM Big Bet:

“BPM will return 10x by making a discovery and defining a deposit significant enough to move into development studies.

NOTE: our “Big Bet” is what we HOPE the ultimate success scenario looks like for this particular Investment over the long term (3+ years). There is a lot of work to be done, many risks involved - just some of which we list in our BPM Investment memo. Success will require a significant amount of luck. There is no guarantee that our Big Bet will ever come true.

BPM Minerals

ASX:BPM

What is BPM looking for?

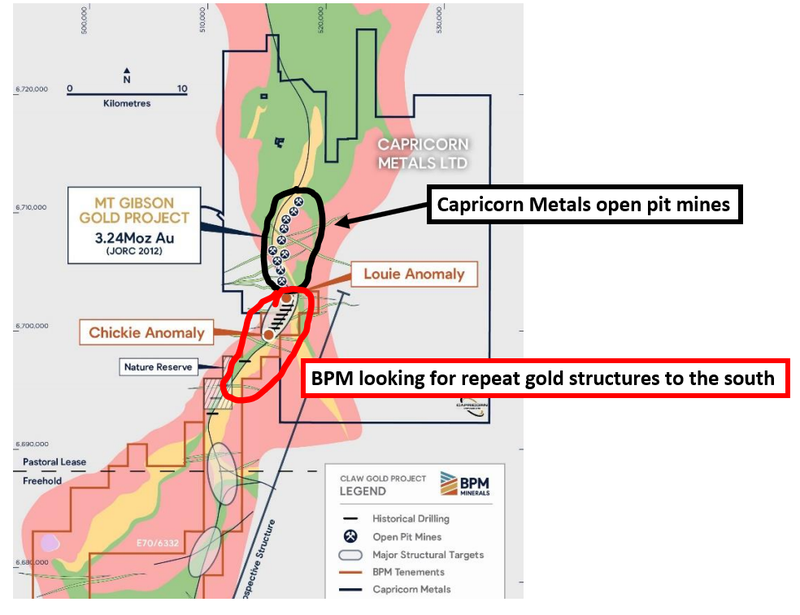

The best way to understand what BPM is exploring for at Claw is to look at what Capricorn has ~500m to the north...

Capricorn’s Mount Gibson project is made up of several open pit mines coming together to form a ~3.24M ounce gold project.

All of the open pit mines (shown as black dots on the image below) run along a north-to-south trend and are along strike from BPM’s project.

So BPM isn't necessarily looking for an extension to Capricorn’s gold project - instead, it is looking for repeat structures along that north-south trend.

If BPM can find even one of these structures, considering the company’s tiny market cap we think it would be a great result for BPM, and the market could reward it.

Just last week Capricorn announced drilling results from its prospect just 500m north of where BPM will drill.

There were a number of intercepts with grades above 2g/t and thickness above 7m.

The best result was 16m @17.16g/t from 32m.

We think that if BPM could replicate even a fraction of the success of this drilling, it could be significant for the company.

However it is important to note that exploration is risky, and there is no guarantee that BPM finds anything of value.

Our “nearology rating for BPM’s Claw gold project

A big part of the reason BPM is drilling its Claw project comes down to “nearology”.

In exploration terms, as the name suggests, “nearology” investments are those that are looking to make a discovery NEAR a larger deposit.

Evaluating “nearology” investments includes a combination of distance and geological similarities.

🎓 For a detailed run through of how we rank nearology investments check out our educational article here: How to evaluate “nearology” investments.

Our scale works as follows (rating of 4 being the best):

- ✅ “Entry level” nearology - If two projects are geographically close its good. But if the geology is different, then it's almost irrelevant.

BPM’s project is less than 500m away from Capricorn’s project.

- ✅ “Better” nearology - Two projects have the same geology and structures, but having no supporting data or drilling downgrades it.

Capricorn just recently hit over 17.16g/t in a drill intercept right next to BPM’s project.

BPM also has soil anomalies and rock chip samples with gold grades up to 0.54g/t from historical AC drilling data.

- ✅ “Even Better” Nearology - Two projects have the same geology and structures WITH supporting drilling / geochemistry.

Through historical drill holes and data there is supporting evidence to suggest that there is gold at BPM’s project.

- ❓“Best” Nearology - There is an extension of the same deposit.

We will find out whether BPM can find extensions to the discoveries made by Capricorn to the north through its current drilling campaign.

We think BPM’s project sits somewhere between level 3 and 4 on our “nearology” scale.

This is primarily due to historical drilling data and the close proximity of the deposit.

If BPM can show the “best” nearology with this upcoming drill campaign - it will be a very good result for the company.

Our expectations for the drill program

Like all exploration, we have set up a bull/bear/base case scenario for this drilling.

We like to do this BEFORE the drilling results come out, so that we can objectively evaluate the drilling results.

Today, we have based our expectations off of Capricorn Metals JORC resource at the Mt Gibson project.

Mt Gibson's current JORC resource sits at 104.9mt at 0.8g/t gold for a total of 3.24M ounces of gold.

So for a first pass drill program a key focus for us will be on grades.

Our expectations are as follows:

- Bull: BPM finds a 5m+ intercepts with gold grades greater than 1.5g/t - this would be a really good result for a maiden drill program especially considering the Capricorn’s JORC is based on grades of ~0.8g/t gold.

- Base: Grades above 0.8g/t but thin intercepts - any hits with grades above 0.8g/t no matter how thin will be a good start to drilling at the project and be enough for us to want to see BPM run at least one more drill program at the project.

- Bear: Grades <0.5g/t - this would probably mean any gold found is too low of a grade to become an economic mine.

Yesterday, BPM announced that it had $3.2M in cash remaining as at 31st December.

With a market cap of $5.3M (at 8 cents), the market is currently valuing BPM’s project with an enterprise value of just ~$2.1M.

This means that the expectations are LOW for the company going into the drilling program.

Therefore, any discovery that exceeds the bull case scenario could see the company’s share price materially re-rate.

Key Risks

Exploration risk

BPM's projects are at a very early stage, most are yet to have high-priority drill targets identified, any drilling programs done in the near-term could return no mineralisation.

Funding risk

BPM is a junior explorer with early stage projects and no revenue or income.

It has roughly $3.1M and is undertaking an exploration program that will cost money.

BPM faces "Funding Risk" as there is always a chance it will be unable to raise enough capital for exploration activities or future drilling programs.

To see all of the risks pertaining to BPM read: BPM Investment Memo

What is next for BPM?

Claw Project

The latest guidance from BPM includes a timeline of events in the lead up to drilling results:

- ✅ November 2023 - Program of work granted by DMIRS

- ✅ December 2023 - Heritage Survey complete

- ✅ January 2024 - Drilling approval granted

- ✅ January 2024 - Site preparations

- 🔄 January 30th 2024 - 10,000m AC/RC Drilling

- 🔄 January 2024 - Soil sample results

- 🔲 March 2024 - Drilling results from Claw Project

New Project Coming?

As we alluded to above, in BPM’s recent quarterly, the company highlighted that it was on the lookout for new projects.

(Source)

So it's possible that BPM brings in another interesting project with the goal of creating value for shareholders.

Our BPM Investment Memo

In our BPM Investment Memo, you can find:

- BPM’s macro thematic

- Why we Invested in BPM

- Our BPM “Big Bet” - what we think the upside Investment case for BPM is

- The key objectives we want to see BPM achieve

- The key risks to our Investment thesis

- Our Investment Plan

Educational resources to help understand today’s article:

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.