2020 Market Outlook Part 3: Impeachment could mark the start of volatility in 2020

Hey! Looks like you have stumbled on the section of our website where we have archived articles from our old business model.

In 2019 the original founding team returned to run Next Investors, we changed our business model to only write about stocks we carefully research and are invested in for the long term.

The below articles were written under our previous business model. We have kept these articles online here for your reference.

Our new mission is to build a high performing ASX micro cap investment portfolio and share our research, analysis and investment strategy with our readers.

Click Here to View Latest Articles

On Wednesday I suggested that 2020 would be a year of volatility for equities markets, and on that note I pointed to some stock selection strategies that can assist in riding out such conditions without enduring too much pain.

More specifically I said, ‘’In such an environment I want a share portfolio that is diversified by sector with a skew towards blue-chip stocks with robust balance sheets and a definite bias towards companies that generate income through the sale and provision of products and services that are difficult for businesses and consumers to live without.

"Companies with strong competitive positions and unmatched proprietary technologies in niche markets generally demonstrate resilience even in tough times.’’

With a view to establishing a diversified portfolio I have focused on S&P/ASX 200 stocks across 10 S&P sectors, the first five of which were covered on Thursday.

Today I select stocks from five other sectors that in my mind best fit the criteria outlined above.

However, my comments on Wednesday regarding the seemingly inflated state of global equities markets, including Australia should be borne in mind.

Rather than representing value at today’s prices, the stocks I’ve outlined may be ones to put on the watchlist, with a view to giving them some consideration when share prices retrace to levels that are more in line with their intrinsic value.

Addressing anomalies within sectors

Before we tackle the five sectors today, I would just like to provide some explanation regarding the make-up of a couple of indices, as that has impacted my approach to stock selection.

The S&P/ASX 200 Materials index (ASX:XMJ) encompasses a wide range of commodity-related manufacturing industries.

Included in this sector are companies that produce and manufacture chemicals, construction materials, glass, paper and minerals, as well as being home to manufacturers of forest products and related packaging products, including producers of steel.

Although they are lumped into the one index, there are significant differences between a manufacturer of paper for example and a mining company.

Consequently, I have chosen to select companies from the S&P/ASX 300 Metals and Mining index (ASX:XMM) in order to select a pure play mining company.

However, within the XMM lies another anomaly in terms of making like-for-like comparisons.

This index contains mining services groups, as well as mining companies exposed to varying commodities.

The most significant clash in my mind is comparing base metal stocks with companies that are exposed to the precious metals industry, which is predominantly made up of gold explorers and producers.

Base metal prices generally have an inverse relationship with precious metal prices as the former normally reacts positively to buoyant economic conditions because of the industrial uses of those metals, whereas gold is seen as a safe haven investment when markets are depressed.

Because of this anomaly, I will be choosing a base metal stock from the XMM and a gold stock from the S&P/ASX All Ordinaries Gold index (ASX:XGD) which contains pure play gold companies.

I will examine the mining indexes after working through healthcare, information technology and communications.

S&P/ASX 200 Health Care Index

The S&P/ASX 200 Health Care Index (ASX:XHJ) includes a number of industry segments, and as such it also provides challenges in terms of making like-for-like comparisons.

However, with a view to identifying defensive resilient stocks, the index provides plenty of options.

Broadly speaking, the XHJ includes companies that manufacture healthcare equipment and supply or provide healthcare related services.

It is also home to a prominent group of companies that are primarily involved in research, development, production and marketing of pharmaceuticals and biotechnology products.

This market segment features many companies that invest heavily in research and development, but in some cases they are still to realise earnings that are commensurate with the capital invested.

Consequently these companies tend to be less defensive than those which generate regular revenues from an established and proven business model.

Popular stocks in the sector are CSL, ResMed and Ramsay Health Care.

The latter has been a market darling over the last 10 years with its share price increasing from approximately $10.00 to more than $80.00 in 2016.

While Ramsay faced some problems in recent years, prompting a retracement in the group’s share price to levels of approximately $55.00, it appears to be back in favour, just yesterday hitting a 12 month high of $74.85, a level it hasn’t traded at since mid-2017.

Ramsay is a global health operator with market leading positions in Australia, France and Scandinavia.

However, with much of its income generated from a large portfolio of hospitals I feel there are inherent risks.

The industry itself is capital intensive and heavily regulated with the increasingly litigious environment presenting further challenges.

Poor hospital facilities and practices are frequently featured in the media and it wouldn’t surprise me to see the industry undergoing a Royal Commission in the not too distant future.

The aged care Royal Commission is already underway, prompted by criticisms of facilities and patient treatment in aged care homes.

This had an impact on ASX listed companies operating within the sector before the Royal Commission even started, and I suspect Ramsay could be the subject of negative investor sentiment if a Royal Commission were conducted.

My pick in the sector is...

Sonic Healthcare Ltd (ASX:SHL)

Sonic is a global healthcare company with a reputation for excellence in laboratory medicine, pathology, radiology, diagnostic imaging and primary care medical services.

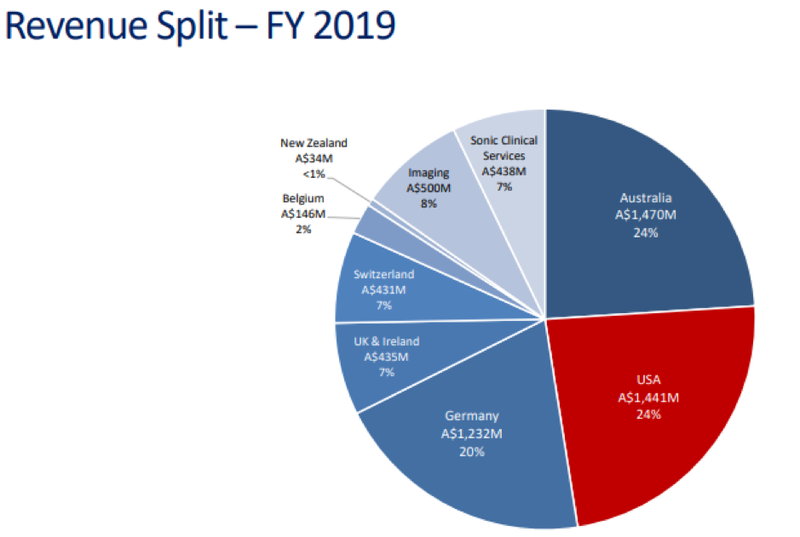

The following shows the company’s diversification in terms of revenue generation.

Sonic has grown to become one of the world’s leading healthcare providers with operations in Australia, the US, Germany, Switzerland, the UK, Belgium, Ireland and New Zealand.

The company has market leading positions in Australia, Germany, Switzerland and the UK.

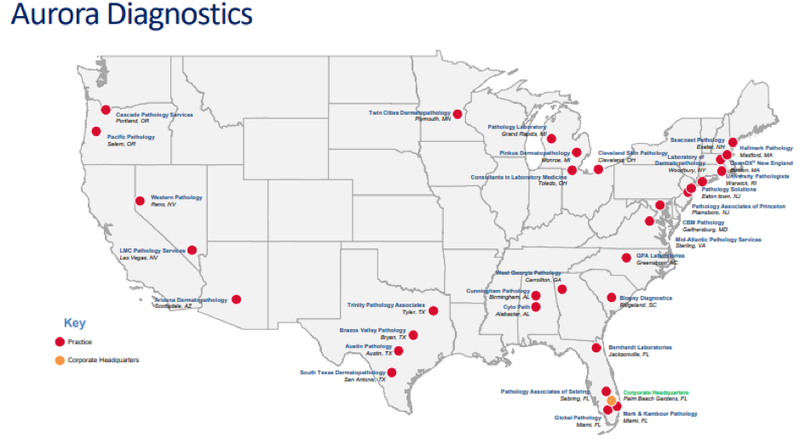

The January acquisition of Aurora Diagnostics in the US added 32 practices and 220 pathologists across 19 states.

It also came with more than 100 hospital contracts serving approximately 23,000 positions.

The acquisition has provided a growth platform in the world’s largest market with the US anatomical pathology market valued at approximately $20 billion per annum.

Management recently highlighted the fact that the company’s robust balance sheet provided head room for further expansion and this would likely incorporate further geographic diversification, more than likely through acquisitions.

From an industry perspective, the medical profession is continually developing technologies that identify problems in patients before they evolve into critical conditions.

In this environment, there is an increasing reliance on pathology and diagnostic services.

S&P/ASX 200 Information Technology Index

The S&P/ASX 200 Information Technology Index (ASX:XIJ) is home to companies involved in areas such as software and services, data processing, technology hardware and equipment.

The index also includes manufacturers and distributors of communications equipment, computers and electronic equipment, along with those involved in the semiconductor space.

Afterpay (ASX:APT) has been the big success story over the last two years with its share price increasing from about $5.00 to more than $35.00 in September.

While it has retraced to around the $30.00 mark, it still looks pricey trading on a PE multiple of more than 100 relative to fiscal 2021 forecasts.

With an eye to where technology is heading and a greater focus on value, my pick in the sector is ...

Appen Ltd (ASX:APX)

Appen is a global leader in the development of high-quality, human annotated datasets for machine learning and artificial intelligence.

Appen brings over 20 years of experience in collecting and enriching a wide variety of data types including speech, text, image and video.

With deep expertise in more than 180 languages and access to a global crowd of over 1 million skilled contractors, Appen partners with leading technology, automotive and eCommerce companies, as well as governments worldwide in helping them to develop, enhance and use products that rely on natural languages and machine learning.

Since listing on the ASX in 2015 with an IPO price of 50 cents per share and an implied market capitalisation of $47 million, the company has consistently under-promised and outperformed, resulting in substantial share price accretion.

The company hit an all-time high of $32.00 in July, but when markets tumbled in August Appen was the subject of profit-taking.

However, as usual this was short lived with management’s announcement of a fiscal 2020 earnings upgrade in November triggering a 30% share price rally.

The company currently has a market capitalisation of approximately $2.8 billion.

Appen provides the likes of speech recognition services to some of the world’s largest tech companies including those that operate global search engines, social media platforms and e-commerce operations.

For commercial reasons, deal flow with these companies is extremely confidential, but to provide a sense of insight, the group has been working with Microsoft Research for 22 consecutive years.

From a broader perspective, the company’s clients are believed to include eight of the top 10 tech giants, including Apple, Facebook and Google.

S&P/ASX 200 Communication Services Index

The S&P/ASX 200 Communication Services Index (ASX:XTJ) is ,as the name suggests, home to companies that are involved in all facets of communications, whether it be owners of telecommunications infrastructure, providers of online advertising or simply diversified media outlets such as Nine Entertainment (ASX:NEC).

There are plenty of household names such as Telstra, NewsCorp and carsales.com.

My pick is ...

oOh!media Ltd (ASX:OML)

OML is a leading media company in Australia and New Zealand that creates deep engagement between people and brands through physical and digital Out of Home advertising solutions.

The group’s connected offline and online ecosystem makes brands more visible to a wider audience because of its diverse network of more than 37,000 locations across Australia and New Zealand.

The company targets high-volume audience locations where viewers are likely to be interested in the products that its clients are advertising.

Locations include roadsides, retail centres, airports, train stations, bus stops, office towers, cafes, gyms, bars and universities.

Oohmedia also integrates experiential, social, mobile and online communications, a high-growth area.

At the start of December, management upgraded its underlying earnings guidance for the 12 months to 31 December, 2019 (the company works on a calendar year financial period), triggering a 30% share price spike.

However, Oohmedia still appears to be good value as it was recovering off a low base after being sold down in August.

The earnings upgrade included positive commentary on the company’s operations with management noting that advertising bookings had improved over the last four months, while capital expenditure was expected to be at the low to mid end of previous guidance.

S&P/ASX 300 Metals and Mining Index

The S&P/ASX 300 Metals and Mining Index hosts a wide range of mining stocks and mining services companies.

However, I will be highlighting a company that provides exposure to a wide range of metals and materials, while also offering investors an outstanding dividend yield.

Rio Tinto (ASX:RIO)

Rio needs no introduction, but from an operational perspective it could be argued that some of its projects fly under the radar.

Also, the company is entering a growth phase with major projects coming on stream in the near to medium-term, most notably the Oyu Tolgoi underground copper-gold project in Mongolia.

The development of this project continued to progress in 2019 as it transitions to one of the largest copper mines in the world.

While there has been a hold-up due to a reconsideration of the mine design, preliminary information now suggests that first sustainable production could be achieved in 2022/2023.

Even at this early stage, the open pit operations have delivered $1 billion in free cash flow since 2013.

Rio estimates that Oyu Tolgoi will have a mine life in excess of 50 years, typical of the company’s approach in terms of selectively developing projects that offer quality mineralisation, low operating costs and a ready cash flow that normally spans decades.

Rio’s performance over the last three years speaks for itself with the company’s $25 billion in earnings representing a return on capital employed of 18%.

During this period Rio generated free cash flow of $23 billion, and the group boosted shareholder value to the tune of $26 billion through dividends and share buybacks.

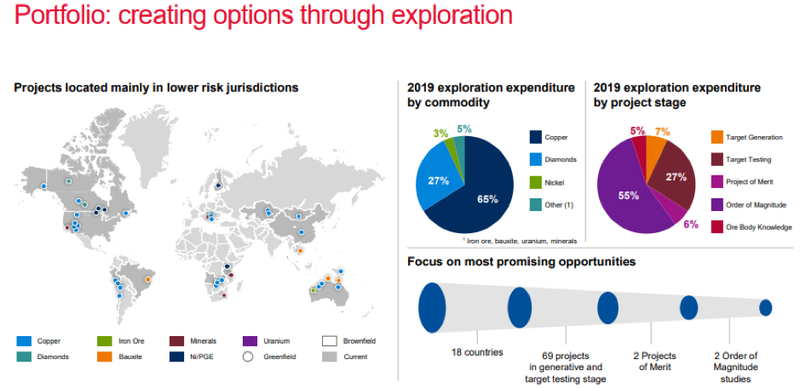

As indicated in the following graphic, Rio provides exposure to a range of commodities such as copper, iron ore, bauxite, uranium, and diamonds.

Some copper mines also benefit from associated gold production which helps Rio in achieving one of its key goals of driving down costs through gold credits, and this will be the case at Oyu Tolgoi.

It would be difficult to find a mining stock that has consistently delivered better shareholder returns, and the company’s performance in 2019 demonstrates these attributes.

In the last 12 months the company’s shares have increased from about $70.00 to more than $100.00, representing a capital gain of around 50%.

Based on consensus forecasts, the company is poised to pay a full year dividend (12 months to December 31, 2019) of $6.69, implying a yield of 6.5%, which on a grossed up basis taking into account franking credits equates to 9.3%.

S&P/ASX All Ordinaries Gold index

The S&P/ASX All Ordinaries Gold index (ASX:XGD) is home to pure play gold stocks.

The companies in this index have operations that span every continent.

While Africa has been a happy hunting ground for gold companies, it comes with sovereign risk, a factor that works against those stocks particularly when markets are volatile.

In the current environment, it is hard to go past gold miners with operations in Australia due to the lack of political risk and the predictability of regulators.

Furthermore, the substantial depreciation of the Australian dollar against the US dollar makes the Australian dollar gold price very attractive.

The spot gold price is currently hovering in the vicinity of US$1480 per ounce and the Australian dollar is fetching nearly US$0.69.

This equates to an Australian dollar gold price of $2150 per ounce.

Given that the average cost of production in Australia is in the vicinity of $1300 per ounce with many mines operating close to $1000 per ounce, the margins are outstanding.

My pick in the sector is ...

Regis Resources Ltd (ASX:RRL)

Regis is an Australian-based producer which on a global basis is one of the lowest cost producers.

This has assisted the company in consistently generating strong cash flows, minimising debt and having a balance sheet with the capacity to fund new projects that have gradually increased gold production.

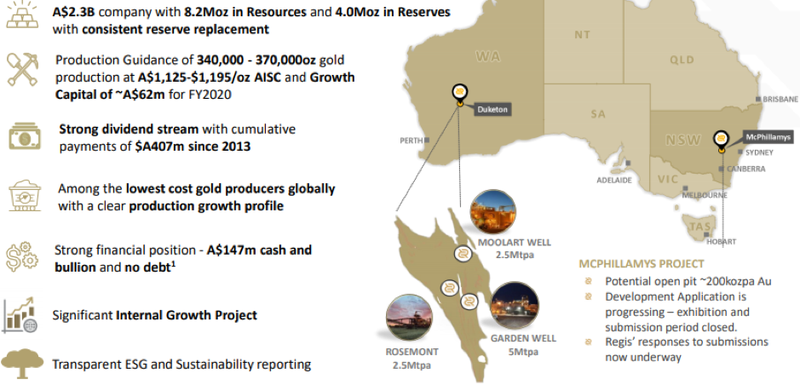

As the following map shows, the company’s producing mines are in Western Australia, but the McPhillamys project in New South Wales will be central to the company’s future.

A development application is currently being assessed, and management anticipates that a potential open pit mine could produce at a rate of 200,000 ounces per annum.

The company has 8.2 million ounces in resources and 4 million ounces in reserves, leaving it well-placed to maintain strong levels of production in the near to medium-term.

Analysts are generally projecting production to range between 370,000 ounces per annum and 400,000 ounces per annum over the next three years with costs to hover in the vicinity of $1120 per ounce, in line with the bottom end of management’s guidance for fiscal 2020.

Based on the current Australian dollar gold price, this provides a robust margin of approximately $1000 per ounce.

Regis is also one of only a handful of gold producing companies that distributes a meaningful dividend.

Analysts are forecasting dividends ranging between about 20 cents per share and 25 cents per share in fiscal years 2020 and 2021.

Regis is currently trading in the vicinity of $4.10 which implies a yield of more than 5% based on the mid-point of the consensus dividend forecasts.

Given Regis’ dividends are fully franked, this implies a grossed up yield in excess of 7%.

Don’t expect the dividends to dry up anytime soon as the company is debt free with cash and bullion of approximately $150 million.

Cashflow from operations in fiscal 2019 was $329 million which comfortably covered dividend payments of $81.2 million.

General Information Only

S3 Consortium Pty Ltd (S3, ‘we’, ‘us’, ‘our’) (CAR No. 433913) is a corporate authorised representative of LeMessurier Securities Pty Ltd (AFSL No. 296877). The information contained in this article is general information and is for informational purposes only. Any advice is general advice only. Any advice contained in this article does not constitute personal advice and S3 has not taken into consideration your personal objectives, financial situation or needs. Please seek your own independent professional advice before making any financial investment decision. Those persons acting upon information contained in this article do so entirely at their own risk.

Conflicts of Interest Notice

S3 and its associated entities may hold investments in companies featured in its articles, including through being paid in the securities of the companies we provide commentary on. We disclose the securities held in relation to a particular company that we provide commentary on. Refer to our Disclosure Policy for information on our self-imposed trading blackouts, hold conditions and de-risking (sell conditions) which seek to mitigate against any potential conflicts of interest.

Publication Notice and Disclaimer

The information contained in this article is current as at the publication date. At the time of publishing, the information contained in this article is based on sources which are available in the public domain that we consider to be reliable, and our own analysis of those sources. The views of the author may not reflect the views of the AFSL holder. Any decision by you to purchase securities in the companies featured in this article should be done so after you have sought your own independent professional advice regarding this information and made your own inquiries as to the validity of any information in this article.

Any forward-looking statements contained in this article are not guarantees or predictions of future performance, and involve known and unknown risks, uncertainties and other factors, many of which are beyond our control, and which may cause actual results or performance of companies featured to differ materially from those expressed in the statements contained in this article. S3 cannot and does not give any assurance that the results or performance expressed or implied by any forward-looking statements contained in this article will actually occur and readers are cautioned not to put undue reliance on forward-looking statements.

This article may include references to our past investing performance. Past performance is not a reliable indicator of our future investing performance.