McKinsey on Battery Materials Demand

Published 21-OCT-2022 13:49 P.M.

|

1 min read

Macro: Lithium

There’s a really interesting article here from McKinsey on the huge demand EVs will create AND how the battery materials supply chain can meet this demand.

Key takeaways:

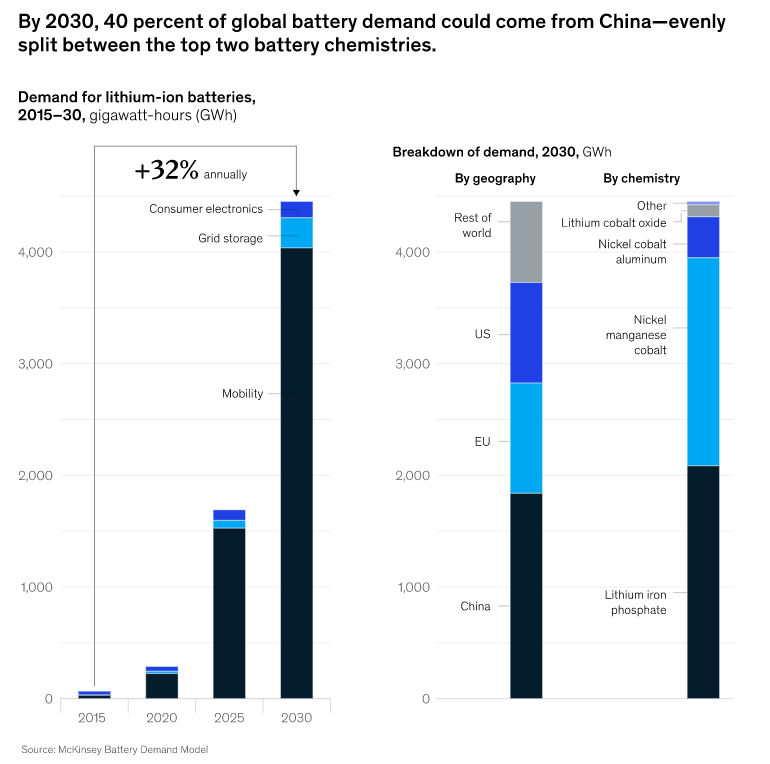

- Lithium and nickel - “the battery industry’s demand for lithium is expected to grow at an annual compound growth rate of 25 percent from 2020 to 2030, while demand for nickel could multiply as battery demand shifts to nickel-rich products”

- Asia making the batteries and Europe buying - “70 percent of the key equipment suppliers, for both coating and general cell assembly equipment, are based in Asia…companies in North America and Europe may need to consider developing strong international sourcing relationships.”

- Geopolitics a major factor - lithium is widely abundant, but ~70 percent of current global production is in Australia and Chile, meanwhile the majority of global cobalt production is in the Democratic Republic of the Congo - which has faced criticism over its mining practices

There’s a great chart here too, which shows the demand growth from EVs and the geography and battery chemistry breakdown:

We’re Invested in a broad spectrum of battery materials companies as part of a decade long investment thesis.

To find out what what battery materials companies we hold in our Portfolio click the button below: